If you’ve been interested in selling or refinancing your home, knowing its potential sale price on the open market can help you decide if now is the right time. Your estimated home sale price will give you a fair idea what potential buyers would be willing to pay for your home based on market conditions, and it’s a vital metric for homeowners to know before selling.

To best find out how much you can sell your home for, you need a real estate professional to conduct a personalized CMA, or comparative market analysis. Getting a professional realtor to do this for you can take around one to two business days to get you unrushed, quality results.

Get a Professional, FREE CMA from Marketplace Homes

What if I want to check my house price fast?

To check your house price fast, you can use this tool from Marketplace Homes right now:

Typically, automated home valuations do not accurately factor in elements that may not be on public records, such as recent home improvements, the true condition of the home, recent storm damage, the most recent changes in the home’s market, any immediate property tax increases (which can lower a home’s price).

Home repairs like a new roof, siding, paint, flooring, and new HVAC system can all improve or maintain a home’s value. Meanwhile, a property that has never been improved will have potential repair costs deducted from the total sales price in a standard real estate transaction. This price deduction isn’t factored into an automated CMA as much as a personalized CMA from your listing agent.

Therefore, to get an accurate estimate, it’s best to consult with a real estate agent who can conduct a professional comparative market analysis (CMA) based on these factors and provide you with an informed opinion on the real potential selling price of your home.

Why the right price matters!

Pricing a home too high or too low both have consequences for home sellers. If the home is priced too far below or above its actual housing market value, the seller experiences a loss and potential delay, while pricing too high puts the entire sale at risk and more delays.

Pricing a Home Too Low

When a home is priced too low, the home may get some degree of attention, but there will be more speculation from buyers about potential defects. This can slow down interest and make it more difficult for the seller to move on to their next home, especially if they depend on funds from this sale.

While an appraisal gap isn’t a risk here, the seller can lose out on hard-earned equity as the net proceeds from the sale would be less than what they could have received if they priced their home accurately.

Pricing a Home Too High

The buyer’s agent representing the person purchasing the home will point out the high price and lower it through the appraisal process and seller concessions. Also, a major risk in high list prices is the chance for an appraisal gap, which can sabotage financing.

If the deal is contingent on the buyer getting a loan approved, know that the bank will only approve a loan for the home’s actual appraised value, not the sales price on the contract. If the buyer can’t pay the difference, they may negotiate a price drop or walk away from the deal altogether. This situation is common in a seller’s market when buyers over-offer to get their offer accepted.

Insights from an Expert Realtor from Marketplace Homes about Selling Quickly

Pricing a home correctly is one of the most important things a real estate agent can do for a listing’s initial marketing success. Christina Ishigami, a Realtor with years of experience helping buyers of new construction homes, gives insider tips on selling a home quickly.

“Pricing is always key. Nowadays, buyers are savvy about price since they have information at their fingertips with Zillow and Redfin price estimates. However, it’s important for them to get a professional CMA (comparative market analysis) from a Realtor to price the home as accurately as possible. That’s how you get the most accurate price the first time.

“If I don’t see much activity on my client’s listing in the first 2-3 weeks, I recommend that they readjust the pricing. If the house is still on the market for longer than one month, I would run another CMA. Also, if a seller is reluctant to lower the listing price despite low interest, I can prepare a net sheet which gives them a good idea of what they would get after closing costs. There are many cases in which a lowered price still gives the seller enough money to move.

“By presenting this information, I can help the client decide to lower the price, as we can only advise them in this situation.

“There are other factors to consider beyond pricing too. Professional photos and neutral staging are important so that the home can appeal to a lot of different kinds of buyers. Marketing it neutrally also matters. For example, if you have a bedroom that’s used as an office, turn it into a bedroom for the photos so people can see it that way. Sometimes, it’s hard for others to imagine that space as a bedroom without the staging. Fresh paint also goes a long way.

“Also, don’t let repairs hold you up. If there are any repairs a seller can make prior to listing, that helps a lot. Listings can be delayed with these projects if the seller procrastinates on them. If they start these projects a week before it can delay the timing. If you know you are going to list the home, start working 3 months ahead so it’s not a mad scramble for you as a seller.

“And finally, you can offer the buyer some seller concessions to lock in a sales agreement. If there is still work to be done, you can offer something like a “$2k spring refresh credit” if the house has minor cosmetic defects. A paid year for a full home warranty or other conveyances can also satisfy the buyer and get the contract signed quickly.”

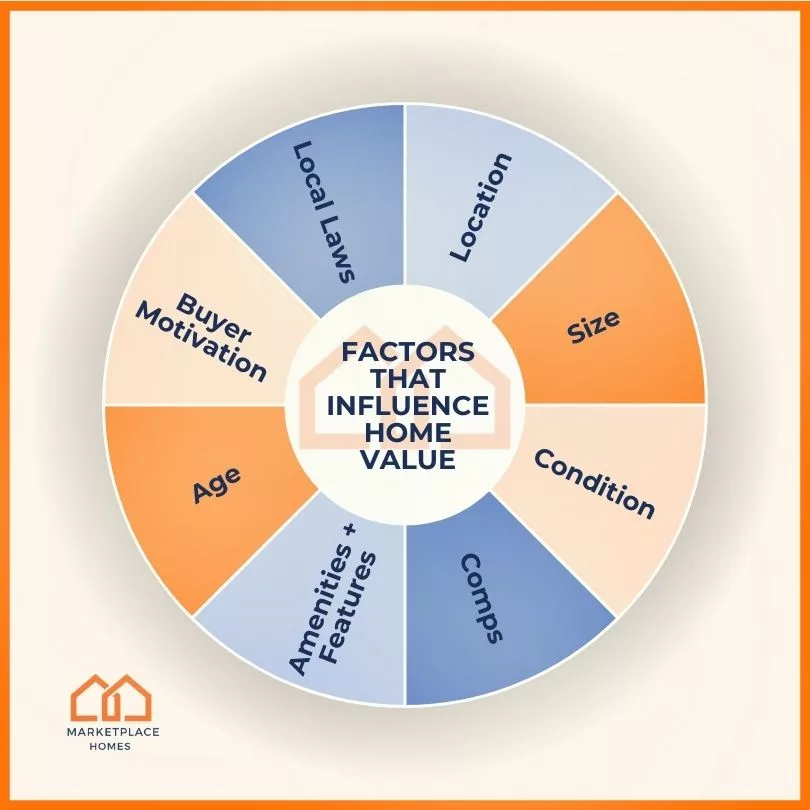

What factors go into pricing a home?

Pricing a home involves considering multiple factors to determine its market value accurately. Only a real estate professional can make an estimate based on all these factors. Automated market analyses will be more limited to public record findings and local market data, which can often be outdated compared to manually prepared CMAs. These factors include:

- Location

- Size

- Condition

- Comps

- Features and Amenities

- Age of the Home

- Home Buying Motivation

- Local Regulations and Zoning Laws

1. Location

They say “location, location, location” for a reason! The home’s neighborhood, proximity to amenities, schools, transportation, and entertainment all affect its value. Never ignore local market trends, which heavily influence a home’s value. Each market has its unique supply and demand dynamics, interest rates, economic factors, and seasonal trends that impact pricing.

2. Size

The home’s square footage, number of bedrooms and bathrooms, as well as the layout and functionality of the home all impact its value. Homes with outdated designs and features, such as having only one bathroom, or featuring asbestos siding, will affect its appeal.

3. Condition

The overall condition of the property matters. This includes any upgrades, renovations, or repairs, affects its perceived value. Also, outdated key elements like an old roof can even make the home too risky for a mortgage lender to approve for a loan. Specifically, most lenders require homeowners insurance, and an old roof can disqualify a house from being covered.

4. Comps

Recent sales of similar properties in the area are called “comps” which is short for “comparable sales”. These homes provide valuable insight into the current market value of the home and heavily influence how your listing agent and the appraiser value homes. It’s also important to pay attention to the condition and age of the homes sold, as some may be more or less updated than the home in question.

5. Features and Amenities

If a home has special features such as an outdoor kitchen, pool, fireplace, private theater, outdoor space, or smart home technology, all of these perks can influence the home’s value in a positive way.

However, owners of homes in low-value areas should be careful about making too many improvements to their home before listing, as buyers in that area will not expect to pay over the average market value for a home in that area.

6. Age of the Home

A home’s age directly affects its value. An old home that has not been maintained is a risk since it may need a lot of updates in electric and plumbing. However, if it has historical significance, that can become a positive factor for potential buyers.

7. Home Buying Motivation

If you are in a seller’s market, low inventory and higher demand can drive up prices beyond the home’s typical market value. A prime example is the market in late 2021 to early 2022.

8. Local Regulations and Zoning Laws

Ahh, the legal stuff. It all matters, and it’s important to factor in things like restrictions, zoning regulations, and local ordinances, which can impact the property’s value and potential use.

Working with a real estate agent who considers all these factors helps sellers list their home at an appropriate listing price that reflects the true market value of the home. This puts the home in the best position for the smoothest selling timeline.

Get a FREE comparative market analysis of your home with Marketplace Homes!

If you’re curious about what your home is worth, you can certainly google your house and check your Zestimate or get some automated CMAs. But if you want a more personalized assessment of your home’s value, contact us today and our real estate experts can take a closer look at your home. We’ll do it for free, and we can also show you all your options, such as buying a beautiful new construction home with one of our creative new construction home programs!