Who’s Buying Houses Right Now?

After 11 interest rate hikes and historic inflation rates after a pandemic that rocked the world, the housing market in the United States (and globally) has been on quite the roller coaster ride. Homebuyers in 2024 have been hopeful that mortgage rates would drop now that inflation is more under control, and it feels like the collective is waiting with bated breath, anticipating the floodgates of real estate demand opening wide.

With low inventory keeping home prices high and pre-2023 homeowners in full on “lock-in effect”, first-time homebuyers anxiously monitor single-family home trends, hoping to find their dream home in the future. So, as affordability and scarcity are still in play, who are the ones buying homes right now? Is it millennials? Boomers? Gen X or Z? We combed through the internet to find facts, stats, and numbers to answer this burning question.

Who is buying houses in 2024?

It’s obvious that in Q1 America’s real estate market is still a continuation of last year’s home purchase trends. But that doesn’t mean that change can’t be in the horizon.

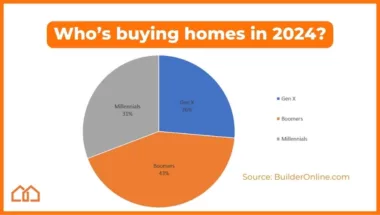

According to Builder Magazine, Boomers make up 43% of today’s homebuyers, followed by 31% Millennials, with Gen X not too far behind encompassing the last 26%. Gen Z is making a minimal breakthrough, with some studies reporting a homeownership rate of 4%. However, according to the National Association of Realtors, Gen Z homebuyers are purchasing the smallest homes among all of American buyers with a median 1,480 square feet.

Overall, it’s apparent that accumulated wealth and home equity is playing a large role in who can afford a down payment and able to buy a new home. Baby Boomers are the oldest and most well-established generation and were able to buy homes when they were a lot cheaper compared to the average household income. The also had more time than any other generation to build home equity. Gen X also has a strong average financial profile, being older than Millennails and younger than Boomers.

While at first glance you’re wondering why Gen X trails Millennials (aka Gen Y) though they are the second strongest generation financially, that is due to the fact that there are simply less of them. Millennials currently make up the largest generation, so though they are less advantaged financially, there have been more of them out there buying houses. Financial backing from Boomer parents can also be a factor.

Source: Builderonline.com

What’s the Hold Up for Gen Z?

Well, first of all, Gen Z is still young. Born between 1997 to 2013, this generation’s age range is between 11 to 26. That alone puts a majority of this generation out of the running for buying a home. A good chunk of this group is still in school or finishing their undergraduate degrees. At most, the oldest ones are entry level to associate level in the corporate world.

Currently, less than 5% of Gen Z are homeowners right now. It’s safe to say that the majority of this generation is either living at home with family or renting homes. According to a survey from Neighborworks America, 59% of long-term renters feel that homeownership is not within their means.

High housing prices, student loans, a sparse housing supply, household incomes not keeping up with sale prices, high interest rates affecting monthly payments for loans, and other logistical difficulties are standing in the way of America’s youngest adult generation and homeownership.

However, the good news is that time, the possibility of lower rates in the future as inflation cools, and the growth of personal finances as Gen Z climbs up the corporate ladder can potentially provide some relief. Hopefully soon, more of these young people can be in a position to qualify for loans and throw their hat in the ring in the home sales game.

Preparing to Buy a Home in 2024

If you want to a new home in 2024, you may want to look into buying new construction homes. Due to the slim pickings of existing homes, a record 32% of home purchases in the last three months of 2023 were new construction homes.

With more variety to choose from, brand new appliances, roof, plumbing, electric, and everything else, new construction is another wonderful option for buyers who are tired of the bidding wars and anxiety of wondering if their offer was accepted. With lucrative builder incentives like mortgage rate buydowns in play, new construction is a highly competitive deal in 2024’s real estate market!