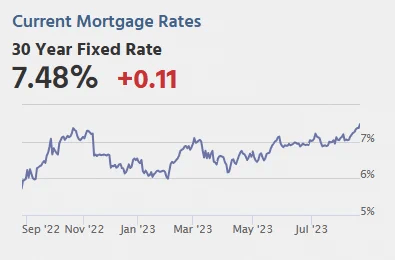

Mortgage Rates Reach 21-Year High

As the average 30-year fixed-rate mortgage interest rate surges to a staggering 7.48%, the highest level seen in 21 years, homebuyers are struggling to find affordable real estate. Taking out a home loan for a $400k house with 20% down at a 7.48% interest rate averages $2,517 a month including taxes and homeowners’ insurance. Compare that to $1,736 a month for a house of the same price in January of last year, when the average mortgage interest rate was 3.584%. That means in 2023, we’re paying $781 more per month for the same property.

It is evident that housing affordability is a major concern, so much so that the National Association of Home Builders (NAHB) recently urged G7 leaders to include housing affordability in their development plans. Regardless of home loan type, whether it’s ARM, 15-year, or 30-year, the cost to borrow with these rate hikes has skyrocketed.

And, since many existing homeowners bought their properties when rates were lower, they are reluctant to move, which keeps inventory low in the housing market. Since low supply triggers higher demand, higher rates aren’t lowering existing home prices … what’s the answer? The solution may surprise you.

New construction homes may just be the most affordable housing option in this market. But how? Why?

We’ll spill the tea.

Why New Construction Homes Can Be the Most Affordable Housing Option

It can be surprising to hear that buying a new construction home can be the most affordable housing option in America right now. But hear me out. When you combine cost with value, plus the ability to get special incentives, new construction is beating existing homes in the long run.

1. Existing homes are rarer, driving their prices up.

Most homebuyers use a lender to buy a home. Interest rates and the home’s sale price directly affect the future mortgage payment. Basically, the higher either figure is, the higher your monthly payment will be.

The recent rate increases have made applying for any loan, including the government-backed Freddie Mac and Fannie Mae loans, more expensive. Also, another confounding factor is that people who bought homes before or during the pandemic aren’t selling their homes much. After all, they scored interest rates under 4%. The mortgage market is in a new era of struggle where fewer people are looking to refinance or become borrowers.

Currently, 60% of existing loans have average rates under 4%. Then, 20% of loans have rates under 5%. That means that only one-fifth of current mortgages have rates above 5%. Long story short: Americans are sitting on their homes. The Fed’s volley of percentage point hikes has made U.S. mortgage rates skyrocket, making moving a risk current that homeowners don’t want to make. This decreased inventory is keeping prices for older homes abnormally high, abiding by the good ol’ economic rule of supply and demand.

Numbers don’t lie. With existing home sales down over 14% compared to last year on average, finding a high-quality used home has been more difficult compared to years prior. However, new construction homes are more readily available, and are along the same price points as competing existing homes. Just take a look at this snapshot from Zillow comparing properties available in Culpeper, VA, right now:

To add some perspective, the house below was built in 1944. Lots of character and charm, but there’s going to be some things to square away during the home inspection. Compare that with the house on the top, which is to-be-built with all modern components. If you’re going to pay the same price for something, it might as well be new.

2. Existing homes come in all conditions, which can make them a potential money pit.

Do you like to buy something imperfect when it’s expensive? Me neither. But that’s what it’s like right now when you buy an existing home. While there are many responsible homeowners who keep up with their properties, you will find others who want to do the bare minimum to list it. (No need for too much anxiety- check out our blog on due diligence on how to spot lemons and RUN!)

However, if you’re going to be paying hundreds more for your mortgage, the last thing you want is to replace a roof or a broken HVAC system after you move in. When mortgages were cheaper than renting, accepting some imperfections was part of the game, but now that stakes are high, buyers have less margin to allow costly repairs.

Enter the new construction home: which has all new components, meaning you are far less likely to need to make a big-ticket repair for many years.

3. New construction homes offer the most competitive incentives in the residential housing market right now.

When you buy a new construction home, builders tend to incentivize the purchase more than sellers of existing homes, offering some of the most competitive rates through their preferred lenders. New construction homes are also far less likely to need big-ticket maintenance which makes the mortgage more worth it than a resale home that may require expensive updates.

While you can still find good resale homes, mortgage lenders for these types tend to offer less incentives, though you can still do a rate buydown and eliminate PMI. To get a full picture of what you can get, start a conversation with a real estate agent that specializes in new construction.

4. You can use equity toward new construction homes to make the deal even better.

“Leading indicators for the economy are strong. The Atlanta Federal Reserve GDPNow tracker, which tracks live GDP growth at 5.8%, which is huge. Yes, rates are higher, but equity markets and economy are strong.” – Will Dickson, President of Marketplace Homes.

With a strong economy, homeowners can cash out on equity to enable more affordable mortgage payments through rate buydowns.

Also, you can use home equity toward a new construction home to afford a high-quality new home while cashing in to provide a down payment that can eliminate private mortgage insurance and pay down points to decrease the cost of borrowing.

5. While traditional new construction sales involve double moving, Marketplace Homes New Construction Programs eliminate this expense.

When you work with a brokerage that specializes in new construction, like Marketplace Homes, you can even save money on timing your move right through unique new construction programs that let you cash out with your first home on your timeline, so you don’t waste money moving twice. You can even stay in your home as a renter through our sell & stay program until your home is complete.

Other brokerages typically put your first house on the market and hope for the best, but at Marketplace Homes, you get total control of when your house sells… because we just buy it. We can also give you a backup cash offer but put it on the market too and see what happens. We like to give our clients the most options so they have peace of mind that they explored every avenue to find what’s right for them.

6. Time is money, and you save it when you skip the competition… and multiple inspection fees.

Buying a new construction home enables you to bypass the “resale embargo” and just get a new home that has everything you want. Why push and shove among the competition to get an older home when you can basically pay the same for a new construction home and not have to worry about big repairs? You can save time in many ways with this route.

First, you don’t have to take off work routinely to go see houses. Secondly, you don’t have to risk paying for an appraisal and home inspection after an offer is accepted only to find you have to back out due to defects. That’s hundreds of dollars each time you back out, which adds up.

7. New construction homes are more energy efficient.

After you move into your new home, there will be ongoing costs on top of the mortgage payment. Utilities also influence personal finances, so having lower bills helps.

Since new homes are built to modern energy efficiency codes, they are going to beat an existing home of the same size in terms of energy costs, especially if it’s been a minute since the old home has been updated. Want to pay a premium only to live with drafty windows and a $400 electric bill? No thanks!

Navigating These Mortgage Rates

As you can see, there are a lot of factors to consider in this interesting real estate market where existing home pickings are slim and expensive. This is why we believe that putting your money into a good product, like a new construction home, greatly reduces the risk of big repairs and high energy bills.

Of course, there are still good existing homes with responsible owners that have kept up with maintenance, so it’s not a one-size-fits all rule. But in this market, it’s a good idea to put new construction homes into the equation as you look for a new place to hang your hat.