Is it Cheaper to Live in an RV or Buy a Home?

RV living has been catching on in popularity these days. Though RVing has long been a pastime for retirees looking to travel the country during the empty nest years, this trend is also getting a big following with younger homeowners who are tired of hefty mortgages and the traditional life path. By living in a camper, working remotely, and homeschooling, these young families and/or singles are taking to the road to travel as they see fit, getting a taste of the nomad life without waiting until their golden years.

While desiring freedom is certainly a factor in this choice, cost savings are another reason why people are choosing to live in an RV full-time. At first glance, the RV lifestyle has a lower monthly cost than owning a home. However, there are some considerations to make for the big picture, such as building equity, vehicle depreciation, and much more. Let’s break it down: is it really cheaper to live in an RV compared to buying a home?

TL;DR: It’s Different for Everyone

The most important takeaway from this post is to understand that just like the cost of owning a traditional home can vary, so can the RV life. According to rvusa.com, “It’s different for everyone”: and it’s really true. A luxury RV can cost more than two single-family homes, while a compact travel trailer RV can cost a fraction of a traditional mortgage payment.

You must decide how much space you want, what kind of upgrades you can afford, upkeep costs (which trend upward as you get more complex), fuel costs, lot rent at national parks, and other hidden RV living costs that make up the total RV owner expense.

RV Cost Calculator

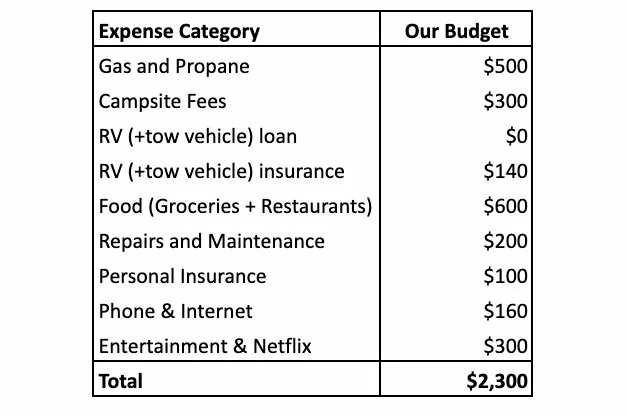

Here is a handy tool to explore if you’re serious about RVing: the RV Cost calculator, courtesy of NomadsinNature. It’s a simple Google Sheet but it helps you line-item expenses of RV living. Take these figures and plug them into this spreadsheet and see what comes up. Here is an example of a frugal RV lifestyle from experienced RVers. Notice that their RV is paid off. If you plan on taking out a loan, expect expenses to be higher than this:

The Cost of Full-Time RV Living

To find out the cost of living in an RV, it’s best to seek the experts. RV Guide’s “Hidden Costs of Living in an RV” is another excellent blog post to give you a taste of what to expect. Here are the main factors these RVers mention as typical living expenses:

Cost of the RV

When you buy an RV, you either pay for it all cash or make a down payment followed by installment payments. According to Motorbiscuit, the average monthly payment for an RV ranges between $250-$650.

A New Class A motorhome RV can cost between $50,000 to $150,000 (source: CostHelper.com). But the sky is the limit when it comes to luxury options, with higher quality RVs easily costing between $200,000 to $500,000 — or climbing above $800,000!

RV Insurance

Just like any other vehicle, insurance is another cost of RV life. No matter what type of RV you own, it needs to be insured for it to be legally on the road. The average cost of insurance is around $1,500 a year. If you prefer to use a tow vehicle with a trailer RV, then you need insurance for both.

Fuel

For RVs to go anywhere, you need gas. It may seem like a no-brainer, but it’s easy to overlook this cost since it isn’t a monthly payment, but an as-needed cost. But you should be prepared to budget for gasoline, especially when the average cost to fill a tank for an RV (or tow vehicle) ranges $100-$600 per fill-up.

RV Maintenance

Whether you tow an RV trailer or drive an RV vehicle, either will need routine oil changes and other maintenance to stay road-worthy. According to debt.com, the average annual maintenance cost of RVs ranges between $1,000-$2,000.

RV Depreciation

Like any new vehicle, a new RV has a sharp depreciation rate. A new RV loses around 25% of its value as soon as you drive it away, another 10% at the end of the first year of ownership, then it loses between 15-18% per year after that. In a nutshell, an RV loses 60% of its value after a decade. You can take less of a hit by purchasing a used RV or negotiate 30% off the MSRP for a new RV, though!

Campsite Fees/Accommodations

When you camp with an RV, you typically pay for a basic 50-amp electric hookup. Fees for RV hookup spaces vary greatly, depending on region, popularity of the destination and whether the campground has basic or resort amenities.

Even if you boondock- or camp for free some nights in a Walmart parking lot or a friend’s house, there are still costs associated with parking. Dump stations are a must, plus you need to refill your water tanks, plus electric hookup to recharge.

Internet

If you work remotely or just want to stream a movie, then you need Wi-Fi in some capacity. Many RVers get along fine with a personal hotspot, which varies in cost but usually costs less than $100 plus data fees.

Want more reliable internet? There is also Starlink for RVs, a rather new high-speed internet dish service that can be used anywhere on an as-needed basis. This plan starts at $150/month with a one-time hardware cost of $599.

Utilities

RVs have utility fees, but not in the traditional sense. You’ll need to periodically refill on water, dump out waste, recharge batteries, and get propane. According to Camper Report, a private RV park can charge $25 to $80 per night, which includes electric and water hookups.

RV Tax

The typical RV vehicle tax is much like a car’s property tax. It’s specific to your state but is generally lower than a single-family home’s property tax rates. But here’s some good news! There are some pretty good RV tax breaks to figure into the total cost of ownership too!

The Cost of Homeownership

This is where things get interesting. If you bought a house before the 2023 interest rate increases, then you are most likely enjoying monthly payments under $2,000. If you bought after the interest rate spike, then you can see a different story. Look at this graphic from Black Knight. More home loans are costing over $2k per month, which makes the mortgage the most expensive part of owning a house. But factors like lower depreciation, equity building, and ROI with renovations help soften this cost.

Home Depreciation Rate

Contrary to RVs, single-family homes depreciate at a slower rate — around 3.636% per year. That’s better than 15-18% per year for an RV. On top of this, you can build on your house and increase its value with strategic upgrades.

Property Tax

Traditional homes typically have property taxes that are higher than vehicle or RV taxes. It’s definitely one of the downsides of homeownership. But since property taxes are particular to your state’s laws. Some states don’t have property taxes, like Colorado!

Utilities/Internet

While you don’t need to pay for campground hookups or water tank fills, you do pay utilities with a traditional home, which range depending on the fuel you use and the size of your home. Internet tends to be cheaper since you can use a standard internet service provider and not a satellite dish or data hotspot.

Down Payment

Undeniably, this can be one of the largest upfront costs of homeownership. While there are 0% down loans out there, you can get much better borrowing rates by putting money down. To be competitive, lenders recommend a 20% down payment.

You Can also Build Equity

Depending on your home’s local market and the improvements you make over time, you can make money off your home by paying off your mortgage. This is something that isn’t possible with an RV. It’s quite encouraging to know that as a homeowner the full dollar amount of the principal isn’t wasted but builds toward money you can borrow against later.

For Both Lifestyles: Basic Necessities

No matter where you live, these costs will be part of your life. Or, they should be.

Supplies/Food

You’re going to need food and gear to enjoy your time on the road, plus camping gear, outdoor furniture, tents, and other things of that nature to expand your space when you’re camped.

Health Insurance

You got to take care of yourself, and health insurance makes sure you can get care without breaking the bank. Unfortunately, health insurance premiums aren’t cheap either. No matter where you live, you need to figure in this expense.

Adventures/Fun Money

You don’t need a lot of money to have a lot of fun, but having some cash for adventures make life fulfilling. The typical RV blogger seems to set aside between $300-$500 a month for some off-the-trail fun.

Furniture & Belongings

With limited space, RVs will generally amount to less furniture and belongings. But living minimally or downsizing in possessions in a regular house can also produce similar results. Shopping secondhand items can also reduce this cost.

Other Debt

Whether it’s a car payment, student loans, or that weird timeshare you can’t get out of until next year, the personal debts you have won’t leave when you get on the road.

The Bottom Line: The Choice Is Yours

Whether you decide to downsize your home and get on the road or plant roots and build a new construction home, how you choose to live is a personal decision. No matter what you do, your choices greatly impact how much you spend per month. While living in an RV gives you the ultimate freedom to travel, owning a home helps you build long-term wealth through equity. There are pros and cons to each lifestyle, but in the end, you have the freedom to choose your path.

- Psst~ If you want the best of both worlds and rent your current home as an investment and travel in an RV- let us manage your property on your behalf. You won’t get maintenance calls or text messages at 2am (we have an online portal to get all of those!) Instead, we’ll market your home, fill it with residents, collect rent, and do the work for you.