If you’ve been watching the housing market this year, you’ve probably noticed a shift. The big coastal markets that used to dominate investor headlines aren’t delivering what they used to. At the same time, something more grounded is happening across the center of the country.

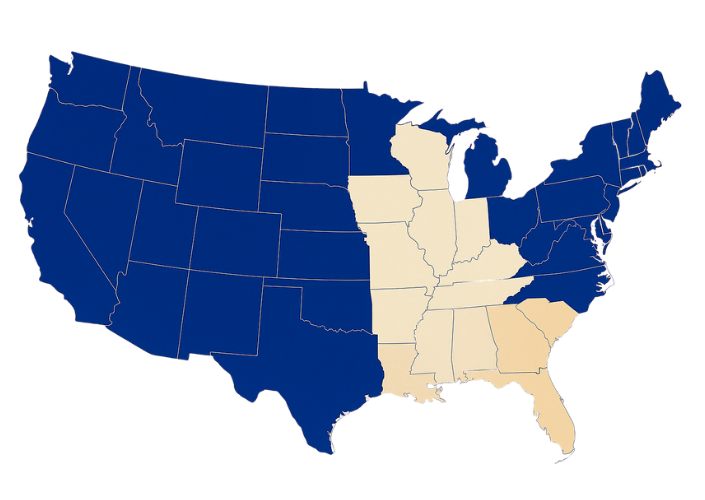

Investors are quietly moving toward what we call the Midwest and Southeast Investment Belt. These are the markets where the fundamentals still make sense. Prices are reasonable, rents are strong, and the returns hold up without taking on unnecessary risk. As we head into 2026, these regions are standing out in a way that’s hard to ignore.

Here’s why.

1. Better price-to-rent ratios make cash flow possible again

In many major metros, home prices grew faster than rents over the past few years. The math broke. In the Midwest and Southeast, that relationship is still healthy.

Cities like Cleveland, Cincinnati, Detroit, St. Louis, Huntsville, Lexington, Greenville, and Tulsa continue to offer price points that support real cash flow. Investors aren’t stretching or squinting to make the numbers work. The homes actually perform.

This gives newer investors a way to start with confidence and offers experienced investors a path to scale without betting on appreciation alone.

Marketplace Homes supports this with detailed underwriting, neighborhood expertise, and management teams already in place, so the transition to ownership is smoother and faster.

2. Population and job growth are pushing rents higher

A lot of the rent growth in this belt comes from simple economics. More people are moving to these regions for jobs, affordability, and quality of life. The Southeast is powerful in tech, aerospace, manufacturing, logistics, and healthcare.

Cities like Nashville, Charlotte, Raleigh, Tampa, Jacksonville, and Greenville are growing fast. More residents mean more demand for rentals. More demand means more substantial returns.

Even the Midwest is seeing steady movement. Detroit’s tech and mobility sectors, Columbus’s medical and research hubs, and Cincinnati’s corporate base have all helped support stable rent growth.

Marketplace Homes helps investors track these trends in real time so you’re choosing markets that match your goals.

3. New construction is actually affordable in these regions

One of the biggest surprises for investors is how affordable new construction still is in these markets. Builders have the land, the scale, and the demand to keep prices within reach, which opens the door for investors who want lower maintenance, predictable expenses, and strong resident retention.

Investors like new construction because it usually comes with:

-

Lower maintenance

-

Better resident satisfaction and longer leases

-

Builder incentives

-

Faster lease up

-

More predictable operating costs

What makes it even stronger for our clients is the option to pair these homes with our Guaranteed Lease Program. Investors can feel confident knowing they’ll collect two full years of guaranteed rent, even if the home sits vacant. It smooths out cash flow and removes one of the biggest early concerns for new construction investors.

When you combine the price points in these markets with builder incentives and guaranteed rent, new construction becomes one of the most predictable paths to scale a portfolio heading into 2026.

4. Landlord-friendly environments help protect returns

Regulation matters. Investors want predictable timelines and clear processes. Many states in the Midwest and Southeast offer more straightforward eviction procedures, lower operating friction, and fewer surprises.

States like Tennessee, Alabama, the Carolinas, Missouri, Oklahoma, Kentucky, Indiana, and Ohio give investors stability. Stability protects both cash flow and long-term performance.

Marketplace Homes strengthens this with in-house leasing teams, centralized renewals, and an eviction legal partner so investors aren’t left trying to navigate the process alone.

5. Long-term appreciation is stronger than people think

There’s a common belief that the Midwest only offers cash flow and the Southeast only offers appreciation. In reality, both regions offer a blend of the two.

The Southeast continues to show some of the strongest appreciation in the country. The Midwest grows at a steadier pace, driven by affordability and sustainable demand. Neither region is as volatile as the coastal markets, which helps investors build long-term growth without taking on wild swings.

Real acquisitions examples from the Investment Belt

These aren’t hypotheticals. These are real deals our acquisitions team found for clients just this month. Numbers are rounded, but the math is real.

Detroit, Michigan: classic cash flow single-family

-

3/1 brick bungalow

-

Built in the late 1940s

-

Priced around $85,000

-

Rented for about $1,250 a month

-

Net yield around 9-11% after expenses

Why it works:

The entry price is low, the rental demand is steady, and it’s a predictable performer. This is a textbook Midwest cash flow deal.

Tulsa and Broken Arrow, Oklahoma: suburban growth with strong mid-six returns

-

4/2 home

-

Priced around $160,000

-

Rented for about $1,650 a month

-

Net yield around 5.8% at list

-

Target yield around 6.5%

-

Offer strategy: adjust price to the high 130s or low 140s

Why it works:

These suburbs offer stable renters and predictable demand. You’re not buying hype. You’re buying steady returns.

Huntsville, Alabama: new construction with real incentives

-

4/2 new construction

-

Builder price around $255,000

-

Investor price around $230,000 after incentives

-

Rented for about $1,700-$1,750 a month

-

Net yield around 6%

-

Eligible for our Guaranteed Lease Program

Why it works:

Huntsville has strong job growth and a great resident base. The incentives help improve cash flow on day one and the guaranteed rent gives investors predictable income while the home stabilizes.

Memphis, Tennessee: higher yield with working-class demand

-

3/2home

-

Priced around $155,000

-

Rented for about $1,450 a month

-

Net yield around 7.5-8.5%

Why it works:

Memphis has long been an investor favorite because the rent-to-price ratio is still strong. The right blocks perform really well.

Dayton, Ohio: small multifamily with scale

-

Six-unit building

-

Priced around $330,000

-

Units rented around $875 each

-

Net yield just under 9%

Why it works:

This gives investors scale without taking on big multifamily risk. One roof, one parking area, and predictable rent demand.

What investors keep seeing across these markets

No matter the city, a few things show up again and again in the underwriting:

-

Entry prices that make sense

-

Rents supported by real job growth

-

Predictable maintenance

-

Room to negotiate

-

Strong resident demand

-

Good property management options

-

New construction opportunities with guaranteed rent

You don’t need a flashy market when the fundamentals already work.

How to position your portfolio for 2026

If you’re thinking about adding rentals next year, here are a few simple steps:

-

Set a clear return target

-

Focus on specific neighborhoods, not entire cities

-

Stress test deals with conservative assumptions

-

Pair every purchase with strong property management

-

Think about building a small cluster or portfolio instead of one-off homes

A simple, well-structured plan usually beats a complicated strategy.

Want help finding deals or underwriting returns?

Our acquisitions team is sourcing, underwriting, and negotiating deals like these every week across the Midwest and Southeast. If you want to see real deals that match your investment goals for 2026, our acquisitions team can walk you through the numbers and help you get started.