If you’re interested in generating income through managing a rental investment, then it’s important to understand the typical routine of rental property management. Knowing the process will empower you to make a choice to either:

- Manage the property yourself.

- Hire a property management company to do the work for you.

Both methods have benefits and considerations for property owners. Today we will discuss what it takes to manage a rental property successfully. The following procedures, when implemented correctly and under ideal conditions, can maximize your chances of earning rental income and minimize the risk of loss and damages.

If you decide to use our property management services, we will do all the work for you. From the background check of prospective tenants, the marketing of your investment property as a rental, to move-out day, you won’t need to do a thing.

To get a better picture about what we take care of on your behalf, here’s what to expect if you DIY manage your property.

Let's talk about managing your property!

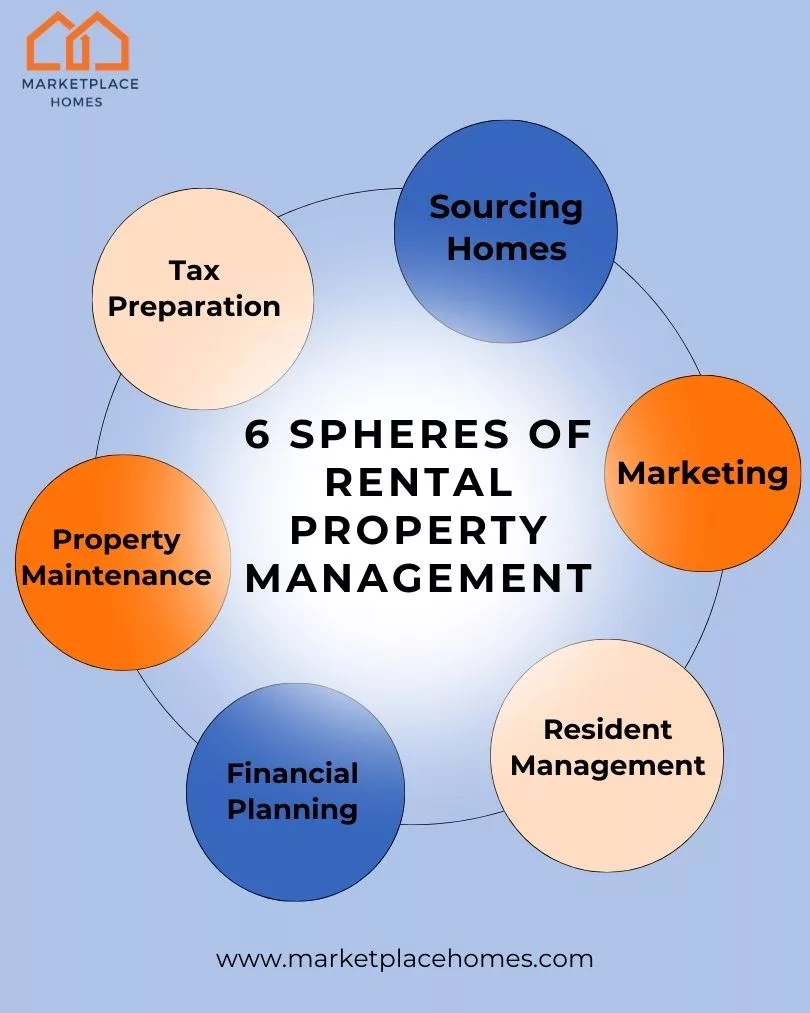

6 Spheres of Rental Property Management

Property management involves diverse tasks that belong to Six general categories: sourcing homes, marketing, resident management, financial planning, property maintenance, and tax preparation. You will also find that property management responsibilities can apply to a couple of different groups. Regardless of how these jobs categorize, it’s vital to stay on top of these four spheres of rental property management for maximum profit potential.

1. Sourcing Homes:

Before you can fill a home with renters, you’ll need to find single-family homes for sale at reasonable prices and in acceptable condition. Most investments do come with repair needs since they come at a discount.

2. Marketing:

Taking photos, staging, creating a rental advertisement, posting the rental ad in strategic places, and setting the right rental price are all part of getting the

3. Resident management:

The tenant screening process, collecting rent payments and deposits, enforcing terms and conditions, sending trades over for repairs, facilitating move-ins, move-outs, and possible evictions are all part of resident management.

4. Financial planning:

Long and short-term budgeting, rent collection, deposit collection, budgeting maintenance, knowing when to withhold deposits, and calculating appropriate rent increases with market trends.

5. Property maintenance:

Routine property inspections, responding to maintenance calls, sending contractors to the rental, and ensuring the quality of repairs. Renovating the property after purchase can belong in this category.

6. Tax preparation:

With all the rental payments and repairs and labor you can write off as business expenses, you need accurate financial reporting to the IRS to maximize your bottom line. You can also easily avoid late payments for quarterly taxes and other mistakes when you work with a tax professional.

- Note: Hiring a professional property management company like Marketplace Homes will take all these tasks off your plate for a competitive rate.

Taking a Closer Look at the 6 Spheres!

Managing rental units requires constant attention and upkeep. Let’s dive into these 6 spheres and explore what’s in store for a DIY landlord.

1. Sourcing Homes

A lot of a rental home’s profitability depends on its purchase price. That’s why sourcing homes is a critical part of the property management lifecycle. Buying low and renting at market value is a good formula to maximize cash flow.

You may find homes on your own with a local broker or work with a hybrid brokerage/property management firm to get you access to off-market opportunities. That combined with a realtor’s excellent negotiation skills during due diligence enhances your chance of getting the best deal— and knowing which deal is worth it.

2. Marketing

Before a resident moves into your rental home, you must advertise it first. Getting your property the utmost visibility requires considerable legwork and potential fees. Overall, the more you do on your own, the less you’ll pay, but it will take more time to find qualified residents. For example, you can list your rental property on social media and get various mixed responses. These potential residents are unvetted, and you must screen them personally.

You may also list your rental on a popular database where you will get traffic. While you will undoubtedly get a lot of interest, this option involves recurrent fees. Also, these services are a-la-carte and usually only help to the point of credit score screening and lease signing. You are still the person with boots on the ground to inspect the home, collect rent, and ensure that the contract is carried out fully.

3. Resident Management

From finding new tenants through a fair tenant screening process, to writing the lease agreement, resident management involves a lot of tasks!

After a resident moves in, real estate investors that manage their own property must be the face of customer service for their property. You must be your residents’ main point of contact whenever they need help. After the move-in, you must answer phone calls, be responsive to any maintenance requests, and ensure their happiness.

You may also encounter bumps in the road, like non-payment or the rare eviction. Screening for good tenants from the onset can usually prevent these scenarios.

Move-out inspections are also crucial because you must compare the property’s condition with how it was before the tenant started to live there. If there are damages, you must tell the resident why all or part of the security deposit must be withheld.

4. Financial Planning

Speaking of finances, landlords must ensure that money coming in exceeds the money going out. They must budget everything related to the investment to ensure that finances are done correctly. For example, the monthly rent must be correctly set to ensure enough income to offset many costs. These often include maintenance, depreciation, taxes, insurance, and other expenses related to keeping up with the property.

- Tip: Smart DIY landlords take advantage of online payment portals like QuickBooks to expedite rent collection, which does cost monthly fees.

You will also need to set up budget reports to ensure your finances are on track. If you do this alone, you will need professional software that could come with a monthly fee for more convenient features. You also need to create an annual and long-range budget to ensure that you are on track with your goals.

5. Property Maintenance

A well-maintained property is your key to ensuring resident satisfaction. It also makes your property desirable, enabling you to rent it for the highest market rate. Any run-down or non-functional will bring in a lower rental rate and not sell as high if you plan on using a buy-and-hold strategy.

Landlords must have strong relationships with local contractors in companies to ensure speedy service and maintenance for resident needs. Regular inspections for roof and HVAC systems must also be in the books to ensure that the property stays in good condition and premature problems can be detected and fixed before they become expensive. These figures must also go into the budget to maintain the property.

6. Tax Preparation

When you have your own rental property, keeping track of all your rental income and expenses can be a hassle. On top of that, how do you know what records to keep as business expenses to help during tax time? Or what about prepaying taxes to ensure you don’t have any financial penalties?

A good property management company will have tax experts to help you navigate record keeping. If you plan to DIY, make sure you consult a tax pro in your area or use tax preparation software like TurboTax which can help you learn about landlord tax write offs.

DIY vs. Property Manager?

Now that you know all the work involved in managing a property of your own, imagine how much time you would save if you outsourced the work for a minimum monthly fee. When you hire a Marketplace Homes property manager to take care of all these tasks on your behalf.

This takes care of everything from tenant screening to the final walk-through in move-out. You don’t have to worry about rent collection, maintenance calls, customer service calls, or any other time-consuming tasks that can take you away from living your life.

Considering all the monthly fees a DIY landlord pays to list on popular websites and to use the best budgeting and customer management software, you can see why spending $99 a month can be more sensible for your budget. You also gain time, freedom, and peace of mind.

Expertise Brings Peace of Mind

If you don’t have knowledge of real estate law, any situation out of the ordinary can cut you into a tailspin. But when you manage your property with a full-service brokerage like Marketplace Homes, you have access to our entire team’s knowledge about property management, customer service, marketing, and real estate Investments.

You will not be alone when challenging scenarios strike, and you will not be on the front lines to handle them either. We will take care of you and your property to ensure the maximum profit for the lowest risk.

Rental Property Management with Marketplace Homes

When you pass on the most time-consuming task to a property manager dedicated to your satisfaction, you can invest confidently. To learn more about real estate investments and how we are experts at managing a rental, download our real estate investor handbook or contact us today. We look forward to making your investment goals a reality.