New Standard Deduction Thresholds for 2024 Taxes

Adjusting for inflation, the IRS has increased figures like the standard deduction and tax brackets. For the 2024 tax filing year, the standard deduction has increased to $29,200 for married couples filing together and $14,600 for single taxpayers. For 2023, the standard deduction is $27,700 for couples and $13,850 for singles. This will provide some tax savings to many taxpayers.

This standard deduction increase is 5.4% higher than last year, which is the second-largest adjustment hike in the past 30 years.

Other 2024 Tax Limit Adjustments

Here are more updates hot off the press:

- The employer-sponsored retirement plan maximum is raised to $23,000 from $22,500. The maximum contribution between employee and employer will increase to $69,000 from $66,000. If you’re over the age of 50, this figure will be $76,500.

- IRA (Individual Retirement Account) limits will increase to $7,000 from $6,500.

- Gifting limits will go up to $13,610,000 per person from $12,920,000.

- The Annual Gift Tax Exclusion amount will be $18,000 per person, up from $17,000.

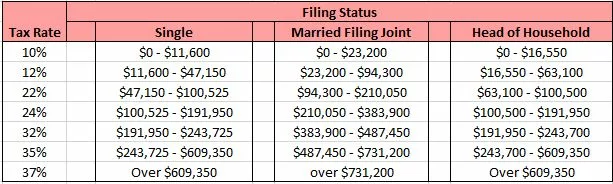

Tax Bracket Increases for 2024

Tax income brackets have also been adjusted, increased from previous tax years.

Source: Cunningham & Associates

When filing taxes for 2023, we will still use the old standard deduction and tax brackets as a guideline. These figures will be useful for planning expenses in 2024 and beyond.

For informational purposes only. To get complete tax insights and advice, speak to a licensed CPA.