Due diligence is an integral part of the real estate process in which buyers and sellers ensure that they make an informed decision in their property purchase or sale. When done correctly, due diligence protects buyers and sellers from unwanted consequences like lawsuits, expensive repairs, and more.

It protects all parties from unwanted consequences related to not checking the property physically and clerically. Sellers can have peace of mind that the property is sold without any legal risks, while buyers can make informed decisions about their home purchase. To have optimal guidance during the due diligence period and throughout the home buying and selling process, work with a Marketplace Homes real estate agent!

Speak with a Real Estate Expert

Specifically, due diligence is the period of time that occurs between when an offer is accepted and the closing day. It is when the buyer needs time to:

- Get an appraisal to ensure a fair price.

- Get a title search, which will find any taxes, liens, judgments, and bankruptcies that are associated with the property.

- Conduct property inspections that may include:

- Home inspection

- Radon gas inspection

- Termite inspection

- Well / septic inspection

- Any other inspection/property survey that’s relevant to buying real property.

Proper due diligence involves careful research, thorough home inspections, and accurate assessments. What else should you know about due diligence as it relates to real estate?

What happens during the due diligence period?

During the due diligence time, buyers must find out of there are any issues with the property. It’s valuable for everyone from first-time homebuyers to seasoned real estate investors. On the contract, there will be a limited time to hire a home inspector and other specialized inspectors. If these pros identify flaws, your realtor can address them and negotiate repairs or enable you to back out without penalties.

For example, if the house was built before 1978, there is a strong chance that it can have lead-based paint . Inspecting for hazards like this can help a buyer negotiate repairs or a reduction in the purchase price. During this time, the title company also does a title search to find any liens or debts associated with the property. Buyers can also learn if there are any issues with zoning, covenants, and potential barriers to getting homeowner’s insurance.

Sellers also need to ensure that the house is clear to close without legal issues. They must order resale documents if the home is in a homeowner’s association and make it available for inspection. Needless to say, a seller’s due diligence checklist is shorter than the buyer’s. Much of the burden is on the buyer and the buyer’s agent.

- Note: This is also a good time for the buyer to check out the neighborhood’s homeowners association. Knowing what is in store will help them know if the home is the right one for them!

How long Is the due diligence period?

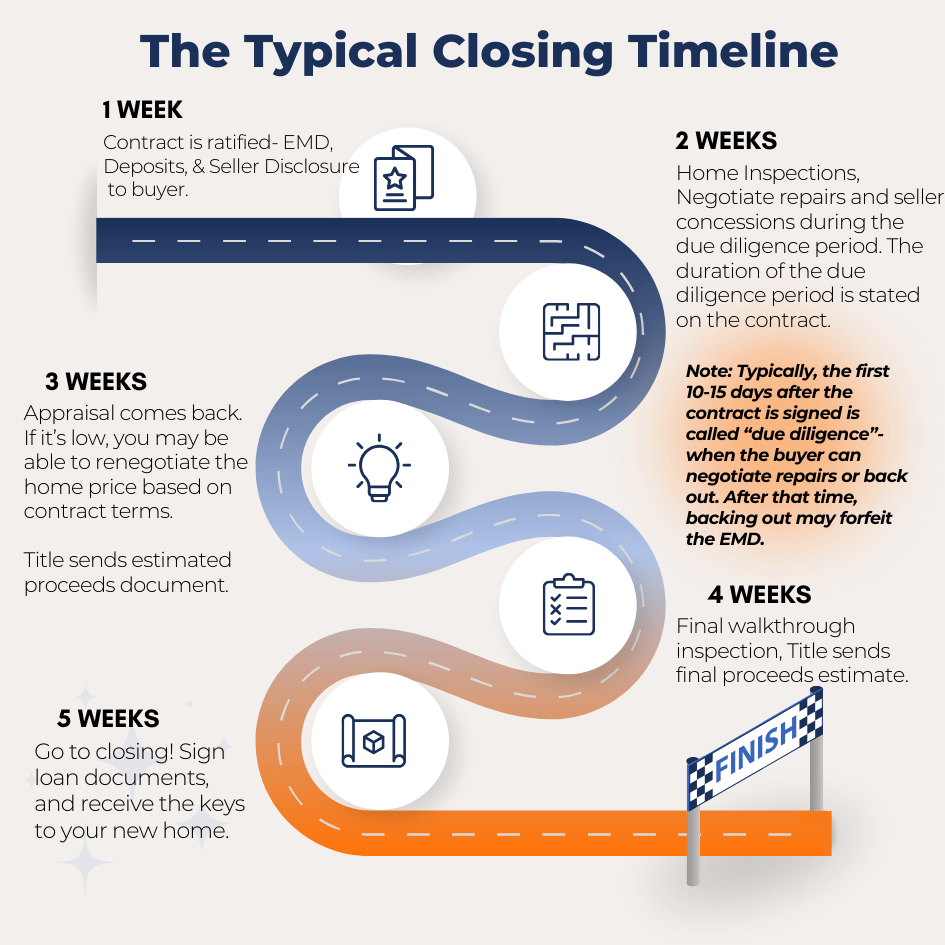

The due diligence period is typically 30 days long, but it can range between 30-90 days. For simpler cash deals, the due diligence period can be shorter, lasting between 7-10 days. Once all parties sign the real estate contract, the countdown starts to closing day. During this time, much of the burden is on the buyer to make sure that the house is good to go.

In the home buying process, it’s vital to check the physical condition of the property so that you’re not stuck with a purchase you regret. This time frame is more than enough for you to acquire proper title insurance, conduct a series of inspections, find a suitable home insurance company, and investigate the property thoroughly.

- Note: A commercial real estate contract is more complicated than a residential real estate contract, so it usually has a longer due diligence period.

Why do buyers need due diligence?

During the due diligence period, buyers obtain essential data from inspections. With this information, you can request that the seller fix problems before closing, or you can walk away from the deal without losing your earnest money deposit in escrow.

You can also test basements for radon gas, check for termites, defective drywall, and the status of the home’s well and septic system. These property inspections protect buyers against buying a money pit. They can also discover other risks, like whether the house is in a flood zone.

- Hot tip: Don’t just send a home inspector! Having a general contractor inspect the home at the same time can help you uncover cosmetic and other functional issues that aren’t on the home inspector’s list. This can help you find out everything wrong with the property, allowing you to request additional upgrades and get a more accurate assessment of the property’s value, allowing you to ask for additional credits or price adjustments before closing.

Why do sellers need due diligence?

Sellers need due diligence to avoid any obstacles to selling their home. In this period of time, sellers must do two main things. First, they must honor the real estate contract and ensure the buyer’s inspectors can access the property. Secondly, the seller must verify that all records related to their property are accurate and up to date.

Having everything in order prevents any obstacles to closing. If applicable, they must prepare all legally required disclosures like homeowner’s association (HOA) disclosure statements, resale packets, and anything else needed to transfer ownership to the buyer legally. This stage protects sellers against lawsuits for not disclosing information before the sale.

Why does this stage have different timelines for different transactions?

Since the due diligence period begins when the contract is ratified and ends on the contracted closing date, it can be wildly different based on the type of transaction. For example, cash buyers don’t need to wait for financing, so they just need to send in an inspector and contractor to spot potential issues before closing. This accelerates the timeline significantly.

If the transaction depends on financing, it will last longer since all parties must wait for the lender’s approval. The lender will be reviewing the buyer’s financial statements, credit history, income, and all other financial stats to ensure they can handle the real estate purchase. Therefore, the typical purchase contract for a residential home can be around 30-45 days.

Also, the complexity of the transaction influences the due diligence timeline. Purchasing a high-value property, commercial property, or a batch of real estate properties will involve more services from real estate attorneys to ensure everything goes smoothly.

Why do buyers need due diligence when they already have a real estate agent?

A buyer’s agent can be a great advocate in negotiations, but they need to know the house’s flaws or potential pitfalls first. Due diligence inspections give your realtor the information they need to speak up for you and work out the repairs and contract terms.

Checking the house is invaluable for real estate investors, first-time homebuyers, and anyone who wants to walk into a situation with full awareness of what they’re buying.

Can you skip due diligence?

Yes, it’s possible to waive inspections and buy your house as-is. You can also not to be thorough about the house’s title and liens. But skipping this process for your new home can result in potential legal and financial trouble, including:

- Inheriting major, costly flaws with the house.

- Title defects causing legal problems.

- Discovering environmental hazards on the property.

- Discovering inaccurate financial data regarding the home.

Overall, if the buyer doesn’t conduct inspections within the limited due diligence period, they put themselves at risk of losing the property in the future due to legal and financial pitfalls.

What else does due diligence do?

Going through the due diligence process protects the buyer to ensure they are getting a good investment. The due diligence period is also crucial for mortgage lenders to determine whether they will approve the loan or if the property is too risky.

Likewise, homeowners’ insurance companies assess their risk. Meanwhile, the title company runs a title report and ensures no defects or claims against its ownership.

It’s a common step in real estate transactions so buyers can legally back out of a transaction that turns out to be a bad deal. For example, if the home inspector notices termite or mold damage, the buyer can move forward with the purchase contract or back out without any penalties (if the contract says so).

While earnest money deposits protect sellers, the real estate due diligence period protects buyers. It’s a practice that ensures that first-time buyers, real estate investors, and anyone else buying real property can make an informed decision.

What If you pay cash in a home purchase?

If you decide to skip using a lender and pay cash up front, you still have some time between ratification day and closing. Even if you don’t have a lender that may require a home inspection, you may still want to take a closer look at the property. You must still go through the title search and all formal avenues to legally buy the house, though.

The real estate agents at Marketplace Homes strongly advise that before you buy a property, at least check how its significant systems are running. HVAC systems are part of the typical home inspection, and a $400 check of the entire house can spot potential defects and other dangers such as asbestos, lead-based paint, termite damage, and more.

Though paying cash can get you out of loan origination fees and interest payments, “invisible” hazards like being in a flood zone (hack: check out FEMA’s flood map here) can blindside you. It’s also wise to check out the area’s crime rates and amenities to ensure that your investment is sound.

Due Diligence: A Vital Part of The Buying Process

Now that we know what due diligence means, you can buy a new home with more confidence. If you have any questions about investment terms or other real estate needs, our realtors will gladly answer your inquiries. We are ready to help you with investment acquisition, real estate disposition, buying new construction homes, or simply finding the single-family home of your dreams.